Product, design, and engineering might not be the first teams that spring to mind when you’re thinking about who can benefit from a competitive intelligence (CI) program.

But if you overlook your techie colleagues, you’re missing out on a huge opportunity to make a real impact in your company.

Here’s how competitive intelligence can benefit your product, design, and engineering teams:

- Identifying the smartest investment opportunities: You can use your CI program to uncover things about your product line your customers dislike, then use this knowledge to invest in developing new products.

- Better products: By casting a critical eye on your own product and the broader market, you can learn what’s working and what’s not and optimize your existing product accordingly.

- Happier customers: Product managers, designers, and engineers pour their hearts and souls into developing great products. But it doesn’t matter how great they think their products are. What matters is what the customers think, and if your product doesn’t stack up against its competitors, your customers are bound to be disappointed.

When to deliver CI to your product, design, and engineering teams

There are two main ways to deliver competitive intelligence to your technical teams.

The first opportunity comes when your teams approach you with a vaguely defined problem they want help with, but they need some help understanding how your competitors are addressing it.

The second opportunity is one you seize for yourself. Perhaps you’ve been doing some win-loss research or other competitive intelligence scanning, and you’ve realized there's an opportunity for differentiation, a threat, or a crucial gap in your product’s features that needs to be addressed.

Scenario #1: They come to you

Let’s start with the first scenario: a technical team needs help investigating competitors’ activities in a problem space they want to play in. Your mission here is pretty simple: you have to help them define the opportunity for the area of investment they're considering.

To kick things off, all you need is the idea they're bouncing around – whether that’s an early product initiative or simply the problem they’re thinking about solving for users.

For instance, they might say, “Hey, we're thinking about improving our product's analytics because it doesn’t give a complete picture of all the user activity.” Great! They don't have to come to you with all the details ironed out – in fact, it’s best if they don’t. This way, you’ll have more room to be part of the creative process.

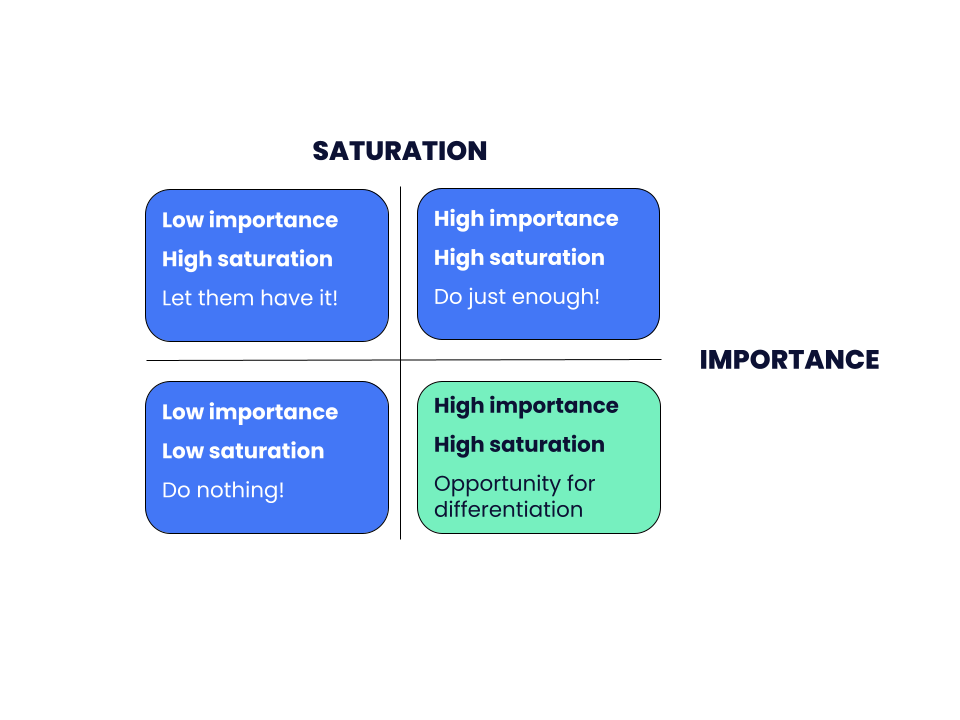

Now, what you’re looking for is a product investment area that really matters to your customers – and where there's either a lack of existing solutions customers actually like using. That's your secret sauce for spotting opportunities: zeroing in on areas customers care about, where they’re not too happy with what's already out there.

This neat little 2x2 analysis works wonders at any level. You could be making big-picture decisions about which new markets to step into, or narrowing down which product features should be the star of the show for the biggest competitive impact.

So, how do you get the ball rolling? Start by asking your team to brainstorm a dozen or so ideas for how to solve this problem for customers. Then it’s time to put on your detective hat and start investigating what your competitors are up to in this problem space.

You’ll want to check out your win-loss research archives for any juicy tidbits, and dive into all kinds of online resources, including:

- Your competitors’ websites.

- Industry analyst reports.

- Review sites.

The next thing on your checklist is figuring out what's really important to your customers and how satisfied they are. At this point, it’s a great idea to bring in some other types of user or persona research to get a grip on how much each potential investment will matter to them.

All this research is going to lead you to a hypothesis, which might sound something like this:

This hypothesis should tie back to the core competitive positioning guiding your whole competitive strategy.

As you’re pulling together this hypothesis, just remember: some product investments are more about setting the stage for the star features of the product to shine – and that’s fine. Not every part of the product needs to be a standout in its own right.

Scenario #2: You go to them

Alright, let's switch gears and think about scenario number two, in which you, the CI pro, reach out to the product, design, or engineering team. This will most likely come about when you spot a competitive weakness or risk that has slipped under their radar.

Now remember, these teams are typically swamped with a ton of feature requests, sales feedback, executive feedback, and suggestions about what they should be working on. Be patient, be empathetic, and make sure you respect their time.

Approach the product manager, designer, or engineer and ask if they can spare 30 minutes for a chat. You don’t want to come in hot and start throwing demands around; instead, frame it as a question: “We've found a potential competitive weakness here. Is there anything in our current plans that might help us tackle it? If not, can we brainstorm some solutions?”

You’ll probably find they have some valuable insights on temporary workarounds or tweaks to the product. They may even suggest roping in partners to help until they can build a long-term solution.

How to consistently enable your teams with the intel they need

So far so good, right? Either your product manager comes to you because they need help assessing a problem space, or you go to them because you’ve spotted a competitive weakness.

Well, it’s a good start, but there’s just one problem: both are reactive.

If you want to drive consistent value for your design, engineering, and product colleagues and have an ongoing influence on your product roadmap, you need to proactively provide them with competitive enablement materials – just like you would with your sales teams.

Now, with all the research you’re doing, you could easily deliver page upon page of competitive intel, breaking down each individual feature your competitors offer. Sadly, the response you’d get on handing over your lovingly collated reams would likely be a weary “So what?”

You can make everyone’s lives easier by sharing concise actionable insights and suggestions and cutting straight to the “So what?

This is where your secret weapon comes in: the battlecard. Let’s take a look at how to build it.

Your battlecard template for product, design, and engineering teams

Competitor name

Overview: A brief introduction to the competitor.

Product

- Product description: Overview of the competitor's product.

- Unique selling proposition: What makes the competitor's product stand out?

- Pricing: How much does the competitor's product cost? Break the pricing down by plan level if applicable. Use competitive pricing intelligence techniques to collect this data.

Customers

- Break down the competitor's typical customers by segment.

- What pain points do they use this product to solve?

- Key customer names (if publicly available).

Market perception

- Summarize how the competitor is viewed in the market. Include notable positive and negative feedback.

- What do reviews on platforms like G2 or Capterra say?

SWOT analysis

- Strengths: What does the competitor do well?

- Weaknesses: Where does the competitor fall short?

- Opportunities: What market trends or changes could the competitor take advantage of?

- Threats: What could potentially harm the competitor's success or growth?

Response strategy (The most important bit)

- Lessons learned: What can we learn from the competitor's product? Are there features or designs that they've implemented well that we can take inspiration from or improve upon in our own way?

- Opportunities for differentiation: Where does our product excel compared to this competitor? What unique features or designs does our product have that provide a better solution for customers?

- Competitor feature gaps: Where does the competitor's product fall short? How can we fill these gaps in our own product, or make our solution more appealing in these areas?

- Addressing weaknesses: How can we improve upon areas where our own product is currently being outperformed? What adjustments or additions need to be prioritized in our product roadmap?

- Future developments: Given the competitor's product trajectory, what can we anticipate for the future? How should our product strategy evolve to stay competitive?

Common challenges when working with product, design, and engineering teams

Your product managers, designers, and engineers are playing a whole different ball game compared to your usual consumers of competitive intel – sales teams. Sure, the information you share might be similar, but their needs, mindsets, and how they use CI are not.

This can present some challenges. It's like trying to play chess after mastering checkers – the setup looks familiar, but the strategies and end goals can differ quite a bit.

So, let's dive into some common challenges you might encounter when delivering competitive intel to these teams, and more importantly, let's explore some practical solutions.

Challenge #1: Convincing teams of the importance of competitive intel

Sometimes, these teams can be so engrossed in their own tasks and deliverables that they overlook the value of competitive intel. They might question why they need to care about what the “other guys” are doing.

Solution:

You’ll need to demonstrate how competitive information directly benefits their work. Show how it can inspire new ideas, help them dodge potential pitfalls, and inform strategic decisions. Explain that understanding the competition isn't about copying them, but about staying a step ahead and carving out your own unique place in the market. If you can share a real-life win, all the better.

Challenge #2: Maintaining ethical and compliant practices

It might be tempting to delve too deep into a competitor's product, but there's a fine line between comprehensive research and corporate espionage. This is a tightrope to walk, but it's absolutely crucial to maintain ethical and compliant practices.

Solution:

First and foremost, when you’re interacting with competitors or signing up for their products, make sure you’re transparent about it and always use your real name and official company email.

Secondly, respect the terms of service. Some companies might have restrictions on what types of analysis you can perform, who can perform it, and what you can do with the results – make sure you respect those restrictions.

Furthermore, you should steer clear of gathering intel on your competitors with the sole intention of dragging their names through the mud. Instead, use what you learn as a springboard for improving your own offering.

Finally, don’t encourage your product development teams to copy or reverse engineer your competitors’ features. Not only might this be illegal, but it also fails to foster innovation. Instead, work to understand the concept and build on it to make it better.

By maintaining these ethical and compliant practices, you're not only preserving your organization's reputation but also promoting a fair and healthy competitive environment.

Challenge #3: Integration into existing workflows

Another challenge is seamlessly integrating competitive intelligence into the existing workflows of product, design, and engineering teams. They're already juggling a ton of demands, and we don't want to make things even more complicated.

Solution:

This is where technology can be your best friend. With tools that these teams already use (like Jira, Slack, or Trello), you can share competitive insights in a non-disruptive way. This might mean creating a dedicated Slack channel for competitive updates or attaching relevant intel to Jira tickets.

Challenge #4: Timeliness and relevance of intel

It's not just about having competitive intel; it's about having timely and relevant intel. Outdated information or data unrelated to the teams' current projects isn't going to win you any fans.

Solution:

Regularly update your competitive intel and always show how the information is relevant to stakeholders’ ongoing projects. Keep the teams involved in the process by asking for their input on what kind of competitive information would be most useful to them.

No product is created in a vacuum

The Competitive Positioning Playbook teaches you...

👷 How to blend CI and customer research for a rock-solid positioning strategy.

🙅♀️ The three steps you must not skip in crafting competitive positioning.

🪛 A top-to-bottom tear down of the positioning process, and how CI fits in.

🏹 How to use competitive positioning to shatter your org’s revenue ceiling.

Interested? Click the button right now to check it out.

Key takeaways

Phew, we've covered quite a bit of ground here. Let's quickly recap some of the most important nuggets we've dug up:

💡 Competitive intelligence (CI) isn't just for the sales teams, it's a game changer for product, design, and engineering teams too. Don't miss out on the chance to equip your entire organization with actionable competitive insights!

🎁 By delivering CI, you can help these teams identify golden investment opportunities, build better products, and keep your customers grinning from ear to ear.

🔍 When these teams come to you with a problem area they want to explore, your goal is to help them find a clear opportunity. Take their early ideas and dive into research to better understand customer needs and competitor offerings.

💬 When you find a competitive weakness, don't just drop the bombshell. Frame it as a question and engage your teams in the process of finding a solution.

🎯 Competitive battlecards are a great tool for keeping these teams in the loop about what’s going on in the market, so they can make more informed decisions.

🚀 Product, design, and engineering teams have different needs and uses for competitive intel compared to sales teams. Tailoring your approach to each team and providing actionable insights will make your intel more impactful.

😇 Staying ethical and compliant is key, even when the competitive landscape heats up. Remember, honesty and respect for terms of service are non-negotiable.

🎩 Persuading these teams of the value of competitive intel can sometimes be challenging. Make your case by demonstrating how it can help them better understand the market and stay ahead of the game.

🤝 Empathy and respect go a long way when collaborating with these teams. Their job is complex, and your understanding and support can foster stronger working relationships.

Remember, your goal in delivering CI is not just to inform but also to inspire and facilitate better decision-making among your teams. So take these takeaways, sprinkle in some of your own style, and get out there and make an impact! 🎉

Need help with competitive intelligence?

Does your competitive intelligence program leave something to be desired?

Imagine if you could:

- Set up your listening stack to gather competitive intel with ruthless efficiency, giving you more time to analyze, enable, inform, and become your business’s champion. 💪

- Set up win/loss interviews to unveil the powerful reasons why customers aren’t choosing you, even if you’ve got no time or resources. 🔎

- Deliver a competitive news briefing that gets people talking, no matter which set of stakeholders you serve. 📣

We’ve got a brand new course that covers every aspect of competitive intelligence, and what it takes to be successful.

Interested? Click below right now to check it out.

.png?v=d18cad0c33)