Pricing is one of the most crucial parts of a company’s strategy due to its immense impact on revenue.

It is also a very sensitive topic because of this direct connection to revenue, and companies don’t rush to publicly reveal their pricing plans and strategies.

Competitive Intelligence (CI) professionals play a crucial role in identifying, gathering, and analyzing competitor pricing data to inform strategic decision-making.

From my experience, companies that are very private about their pricing are either startups that probably want to leave more room for flexibility in their first deals or more “legacy” companies with complicated pricing models that may scare customers away right off the bat. But even then, you’ll usually be able to get a certain understanding of what that model looks like.

In my opinion, the cloud of secrecy hovering over the topic and how difficult it can be to uncover these insights only make it more satisfying when you are able to form a relatively clear picture of the pricing landscape.

In this post, I’ve gathered some of my personal best practices for acquiring competitor pricing intelligence and transforming that data into actionable insights. I’ve focused on what usually works for me, and I hope you find a few useful tips!

Step 1: Setting clear objectives and defining the scope

Any good research project starts with defining its objectives, and pricing intelligence is no different.

Before diving into data collection, understand what you need to achieve. If you are working with a stakeholder like a Product Manager or Pricing Strategist, align on the goal of your research. Whether you aim to benchmark industry standards, uncover trends, or get intelligence on competitors’ discount strategies, understanding your goal shapes your research and analysis strategy.

The most common compelling event for pricing research is a new product launch, when the organization needs to figure out how to price that new product against existing competitors in the market. The goal here would be to conduct a comparative analysis to provide stakeholders with visibility on the industry benchmark and how others price similar solutions so they can better price their own solution.

Another example of a research goal is to uncover competitors’ discounting strategies and help your organization understand how other companies deal with customer engagements in order to compete better and provide similar or better discounts. This will involve questions like:

- Does this competitor normally provide discounts?

- What type of discounts? Multi-year deals, volume discounts, buying out the remainder of the existing contract?

No matter the goal, you will also need to define the scope of competitors relevant to the specific study—select direct and indirect competitors with similar target markets or product offerings.

Note that when entering a new domain or launching a new product, this might not be 100% obvious—remember to look further than just your direct competitors and search for other solutions that solve the same pain for customers.

You might have to go through a few iterations to get it right.

Step 2: Sourcing data from reliable sources

Competitor pricing data can be sourced from a variety of places:

- Public sources: Websites, price comparison tools, e-commerce platforms.

- Primary research: Customer surveys, direct interviews.

- Secondary sources: Industry reports, financial filings, and analyst reviews.

These are my own tried and true sources, to which I will turn to first and usually do the job:

- Vendor websites - Pricing page

This might go without saying, but the competitor’s website is the first place you should look for pricing information. Some vendors will offer full or near-full visibility into their pricing model and costs, but even if they don’t, you might still be able to tell what type of pricing model they offer or how they package their product. - Vendor websites - Documentation

If the pricing model isn’t available on the vendor’s website, and even if it is, you might be able to get information from their documentation. Look for a “Billing” page that could explain how the pricing model is built. - Cloud marketplaces

If your competitors are SaaS or cloud products and pricing isn’t available on the vendor’s website, it’s likely available on the cloud marketplace. Search for the vendor’s seller page or specific product. It might not be the precise pricing model, but it will probably give you some indication of the price range. - Review websites

Sometimes customer reviews on websites like G2 or TrustRadius include pricing or discounting information. - Human intelligence - customers and former employees

A great way to get deeper insight into competitors’ pricing is to conduct interviews with customers who have used competitive products, or with new employees at your company who previously worked for a competitor.Some customers will even share discounting information they got from other vendors - which is like striking gold!

Step 3: Analysis

Like everything in CI, the key is to not only gather pricing data but also to extract actionable insights that inform strategic decisions and contextualize the data within broader market dynamics and competitor strategies.

Naturally, the type of analysis will change according to the research goal.

Here’s what I normally take into consideration when analyzing competitor pricing:

- Normalize data: Adjust prices for differences like currency, packaging size, or unit types to ensure a like-for-like comparison. Companies don’t always price their products in the same way. Some use a user-based model, and some use a consumption-based model. It’s usually not an apples-to-apples comparison, so try to find the price of the base unit that will make the comparison a bit easier.

- Categorize product tiers: Group competitors' products by categories or tiers (e.g., premium, mid-tier, entry-level) and analyze pricing within each group. Are they targeting SMBs or enterprises with their pricing? What features do they include in each tier for each of these groups?

- Refine and review the competitive landscape: As mentioned before, you might have to go back to the drawing board a few times to pinpoint the right competitors for the research scope. This is good! Especially when you’re entering a new domain or launching a new product, this process helps refine the competitive landscape for further research and positioning.

Step 4: Communicating insights to stakeholders

I’m sure you’ve done a great job collecting and analyzing the data – but it doesn’t end there.

Turning data into strategy requires effective communication. Delivering insights that are clear, relevant, and aligned with stakeholder needs ensures that pricing intelligence drives decision-making.

Tailoring your findings to different stakeholders is essential. Executives may require high-level summaries, while pricing teams might need detailed data analysis.

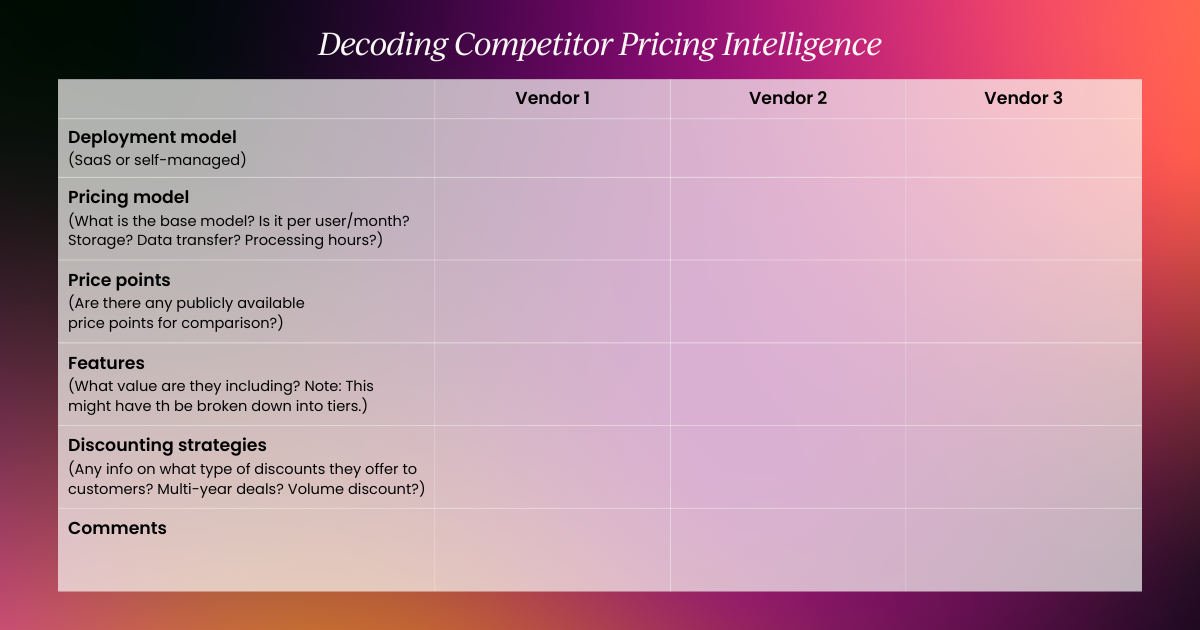

Here's a free template to get you started.

.png?v=8793260410)