Staying ahead of the competition demands a deep understanding of your market landscape. Yet, far too often, businesses find themselves operating in the dark, unable to grasp the nuances of their target audience.

If this sounds familiar, you're not alone. Luckily there’s a solution: market research. In this comprehensive guide, we'll explore what it entails and why it's an indispensable tool for any competitive intelligence expert.

From identifying customer needs and avoiding costly missteps to benchmarking against rivals and optimizing your marketing tactics, market research holds the power to elevate your competitive strategy.

We'll dive into the different types of market research, including primary and secondary sources, as well as quantitative and qualitative data, equipping you with the knowledge to harness each approach effectively.

Let’s get into it. 🤿

What is market research?

Market research is the systematic process of gathering data on target markets or industries as a whole. Its goal is to identify market trends, sizes, growth potential, pricing models, competition levels, and customer demographics.

It typically involves quantitative research methods like surveys, polls, and data analysis. It serves to answer questions like:

- Who makes up the target market?

- How big is the total market size?

- What macro-level trends are shaping the market?

- How are competitors positioned?

- What are average prices and price sensitivity?

This high-level information allows companies to:

- Validate market opportunities.

- Develop new products or features.

- Set competitive pricing.

- Position brands effectively.

- Allocate resources to the most lucrative segments.

- Maximize marketing ROI.

Market research refers to understanding the competitive environment and overall market that your company operates within. This allows you to position your product more effectively in the market.

Why is market research important?

Do Hershey’s launch a new candy bar without taste tests? Do ad campaigns get signed off without test screenings? Or do fast-food chains launch new burgers without checking out what the punters’ taste buds are craving?

Answer: A resounding no.

Rather than acting on a whim, companies complete meticulous market research to improve their chances of a hit, and reduce the likelihood of an expensive pink elephant.

In a nutshell, market research spills the beans on what prompts customers to put their hands in their pockets, buy products and services, and part with their hard-earned cash.

The process is critical to ensure that the best decisions are made by a company. But how does it help, and why should every company sit up and take notice? All shall be revealed…

The benefits of conducting market research

It helps you identify your customer base

It’s impossible to build a successful product unless you communicate with prospective customers. Market research provides a set of definitive answers to key questions, including:

- Who is your product aimed at?

- Who are your customer personas?

- What features do they want from your product?

- How much are they willing to spend?

The market research process allows you to clearly paint an image of:

- your ideal customer – gender, age, location, income, etc.

- the product you’re going to create, as dictated by the needs of the customer.

When you’ve identified who you're targeting and what you’re creating, you’re able to tailor your marketing strategy and pricing plans accordingly, tying each of your product's features to benefits your target customers want.

It can prevent sloppy mistakes

Before launching a product , it’s important to conduct rigorous research and testing , to avoid silly (and expensive) errors.

Let prospective buyers test it out beforehand, so you can iron out any imperfections by conducting market research.

While your gut may tell you your product will resonate with consumers, making decisions based on gut instinct alone isn’t a great idea; if things go wrong, you’ll be left ruing your choice not to do some simple testing.

Focus groups are a great source of customer and market feedback . If things go swimmingly, you’ve got the peace of mind you need, and you can push on with the launch. If there are areas for improvement, just go back to the drawing board and make your service even better.

It can protect your business

Market research not only indicates what the market is like now, it allows you to forecast how your industry could shape up in the future.

Proactivity helps you exploit potential gaps in the market other companies may not have spotted, so always stay on your toes and keep your eyes peeled for market opportunities.

Take UK record store HMV, for example. While they continued to channel their efforts into the sales of CDs and DVDs, Spotify and Netflix researched the market and developed mobile platforms offering music and film on demand, in line with emerging trends.

In 2019, Netflix’s assets were $34.9bn, and Spotify was being heralded as ‘the savior of the music industry’, while HMV called in administrators for the second time in six years.

Winner: Market research, by knockout.

It allows you to size up opportunities

How big could your market be? Are there adjacent segments ripe for expansion? Market research surfaces crucial data on market size, growth rates, and demographic factors that make new ventures viable.

It also maps out expansion opportunities beyond early adopters by revealing underserved consumer needs in a category.

It helps you benchmark against competitors

Monitoring competitors goes hand-in-hand with understanding customers. Market research tracks factors like competitor market share, brand awareness, consumer sentiment, pricing, promotional strategies, and perceived product strengths/weaknesses.

These benchmarks help position your business competitively. They also highlight tactical advantages to better meet customer needs in an evolving marketplace.

It informs business strategy

Understanding the market is crucial for any business to make informed decisions. It helps you identify trends that’ll impact corporate strategy and planning. Plus, it provides valuable insights to guide decisions around selecting target markets, developing products or services, creating marketing and sales strategies, and staying ahead of the competition.

It helps you optimize marketing spend

No marketing budget is infinite. Market research identifies high-potential customer segments so you can allocate marketing spend for maximum ROI.

It also surfaces media consumption habits and influencers to refine messaging and choose cost-efficient channels. The end goal is better conversion rates and lower customer acquisition costs.

Looking for next steps?

Competitive intelligence is a powerful growth lever for any organization... if done right.

There are many concepts to master if you're to satisfy your customers, motivate your team, and optimize your workflows.

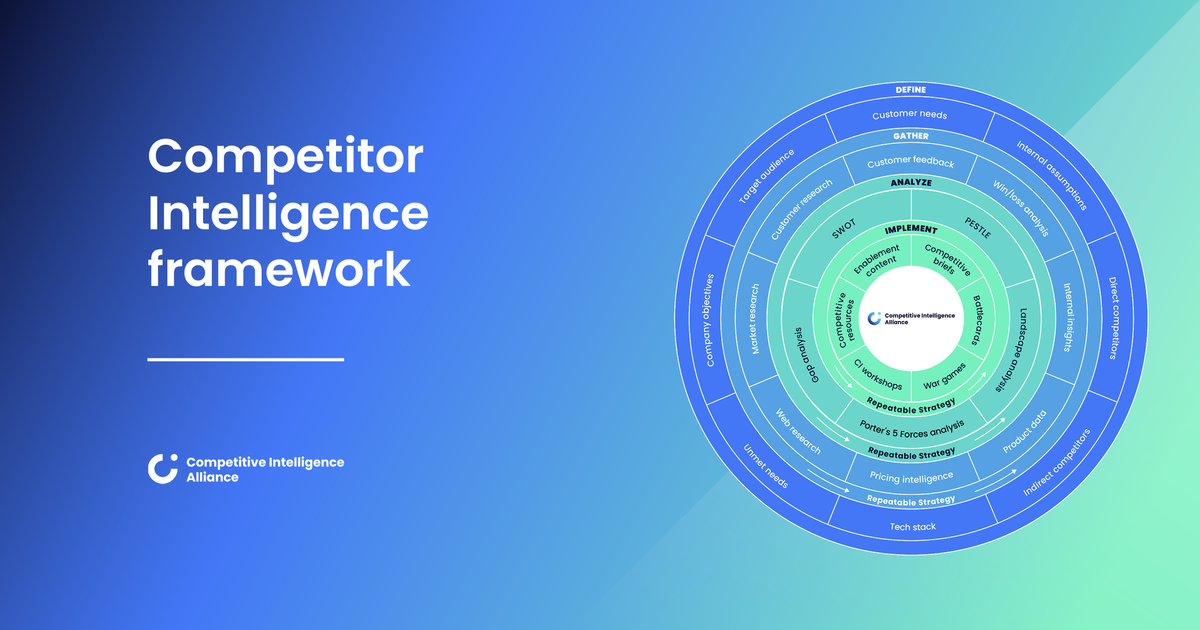

Enter our Competitive Intelligence Framework. 🏁

It covers everything you need to know to navigate the competitive intelligence cycle, from start to finish.

8 ways market research supports customer research

While market and customer research are two distinct practices, they ultimately work towards the same goal: to help you make the right strategic decisions by deeply understanding your audience.

Here are eight ways market research complements customer research:

1. Validating market segments: Market data indicates segments with distinct needs. Customer research explores those needs with real people.

2. Sizing target markets: Macro-level market research gauges potential sales volume for new products or services. Customer research assesses actual interest and buying criteria.

3. Identifying customer archetypes: Market data reveals demographic clusters. In-depth interviews turn those statistics into living buyer personas.

4. Comparing against competitors: Market share metrics show key rivals. Customer studies reveal why people prefer them over you.

5. Selecting new markets: High-level market scans uncover blue ocean opportunities. Customer studies determine product-market fit.

6. Forecasting industry trends: Market forecasts predict future shifts. Customer input guides strategies to leverage them.

7. Choosing marketing channels: Market research identifies major media outlets and influencers. Customer interviews reveal which touchpoints matter most.

8. Pricing products or services: Industry benchmarking provides pricing ranges. Conjoint analysis finds optimal price points.

Primary vs. secondary market research

There are two types of data sources you can use when carrying out market research: Primary and secondary. Let’s take a look at what they each involve and how you can get your hands on them.

Primary research

Primary research is research you conduct for yourself or hire a specialist to collect on your behalf.

For example, at Competitive Intelligence Alliance, we used data we collected ourselves for the Competitive Intelligence Trends report , and we’re continuing to survey members of our community for upcoming editions.

Primary research is based on two types of information: exploratory and specific.

Exploratory research is open-ended, with respondents usually providing their views in an unstructured interview scenario.

On the other hand, specific research tends to be more structured, to solve a particular problem highlighted during the exploratory phase.

How to conduct primary research

When arranging primary research, it’s important to identify your research subjects’ preferred method of communication, whether this is direct mail, phone, or interviews.

These should be considered carefully, given the response rate for each method varies. For example, people tend to prefer a quick chat on the phone over penning lengthy responses to questions sent by email.

Social media is also widely used for conducting market research. Features like LinkedIn polls allow companies to quickly gather opinions from thousands of followers.

Secondary research

Secondary research is research conducted by some other party. You can get it from sources like:

- Reports

- Books

- Journals

- Newspapers

- Letters

- Government websites

Secondary research intel is often available to the public and can be found online or in libraries. Media outlets such as newspaper publishers and TV stations also host a range of information that can be useful for secondary research.

Quantitative vs. qualitative data

There are not only two types of research to be aware of, but also two types of data: quantitative and qualitative. Let’s take a look.

What is quantitative data?

Quantitative data consists of cold, hard facts that can be easily converted into graphs and charts. The research is usually carried out using surveys and questionnaires with closed-ended questions, yes or no questions, checkbox or multiple-choice questions, and questions with intervals or ratios. It’s structured, statistical, and numbers-based.

What are the benefits of quantitative data?

Quantitative data is useful for conclusive answers, it’s easy to analyze and can help prove or disprove hypotheses. The questions are also quicker and easier to answer, so you’re likely to get more responses.

What is qualitative data?

Qualitative data is non-statistical and consists largely of impressions and opinions. It’s generally used to answer ‘why’ questions. It’s investigative in nature and asks open-ended questions. Qualitative data can be generated through:

- Surveys

- Audio and video recordings

- Images and symbols

- Interview transcripts and focus groups

- Observations and notes

What are the benefits of qualitative data?

Qualitative research gives you a deeper insight into the motivations behind the statistics. It’s used to theorize and interpret. Instead of asking how many people buy your product, it asks why they buy it (or not!).

Which data is better for research?

Whether you decide to use qualitative or quantitative data will depend on the results you’re looking for.

If, for example, your product was an app that maps bike routes, using qualitative questions like “What do you think of our app?” will lead to many, many different answers. They might focus on speed, responsiveness, and price, which could be invaluable information for you to look at.

However, if you want a specific question answered, like: “How responsive is this app?”

- Super responsive

- Sometimes responsive

- Not at all responsive

Then, quantitative data is your best bet.

The two approaches aren’t mutually exclusive though. You can gather both quantitative and qualitative data for a more holistic view of your target market.

Conclusion

Market research is invaluable for any CI pro. By tapping into its power, you gain a profound understanding of your target market, empowering you to make informed decisions that help you outmaneuver your competitors and drive sustainable growth. So, don't be afraid to embrace market research and use it to your advantage!

Give yourself an unfair advantage

Our newest competitive intelligence course lifts the lid on the frameworks and processes experts use to deliver impactful intel with confidence.

You can expect:

- A 100% self-paced and online course packed with competitive wisdom so you can stop worrying and start winning.

- Bonus features from established competitive professionals to give you an unfair advantage.

- 6 downloadable, customizable templates and frameworks that make analysis a cinch.

Competitive Intelligence: Core

We'll show you how to:

- 👑 Lead development of your org’s all-important competitive positioning.

- 🦾 Master CI’s essentials, including its most powerful research techniques.

- 🚀 Arm sales and customer success with intel to skyrocket win rates and turn down churn.

- 🧠 Offer leaders critical intel that informs their decision-making and strategy.

- 📈 Elevate CI’s role within your org to ensure career progression.

.png?v=0501614a4a)