Market segmentation is the first step in determining who your target market is. By segmenting potential customers into groups that share similar characteristics, you can identify groups to target further down the line.

Traditional market segments are identified using the following characteristics:

- Demographics

- Psychographics

- Geographics

- Behavioral

5 benefits of market segmentation

By getting to know your customers better, you can create and execute better marketing strategies from the ground up. Market segmentation can help you identify gaps in the market and determine how you fill them.

1) Create stronger marketing messages

When you know who you’re talking to you can personalize your marketing messages. Instead of vague, generic messaging, you can develop stronger, direct messaging that speaks to the unique needs and characteristics of your target audience.

“I think one of the key things you need to nail right away is messaging and positioning, they’re core to any Product Marketing role. If you're not good at messaging, you really can’t do a Product Marketing role. So, be good about figuring out how to message to the right people at the right time. - Sarah Din, Director of Product Marketing at SurveyMonkey

2) Find out what works

With dozens of marketing tactics available, it can be difficult to know what will attract your ideal audience. Using different types of market segmentation guides you toward the marketing strategies that will work best. When you know the audience you are targeting, you can determine the best solutions and methods for reaching them.

3) Create hyper-targeted ads

You can use all the information gathered to target audiences by age, location, purchasing habits, interests, and more to create more effective digital ad campaigns.

4) Stand out from the crowd

Being more specific with messaging and value propositions will set you apart from the competition. By focusing on specific customer needs and characteristics you can deliver products that uniquely serve them, which inevitably leads to stronger customer bonds and lasting brand affinity.

5) Identify niche market opportunities

When you segment your target market, you can identify parts of the industry that can be served and utilized in new ways. Once you’ve pinpointed these underserved markets you can develop new products and services to serve them.

Types of market segmentation

Let’s delve a little deeper into the different types of segmentation listed above and throw in a few examples of segmentation in practice to give you a clearer picture.

Demographic segmentation

Demographic market segmentation gives you basic background information about your customers, aiming to answer the question, “Who are my customers?”.

Demographic segmentation deals with attributes including:

- Age.

- Gender.

- Ethnicity.

- Income.

- Marital status.

- Education.

In a B2B context, you might segment the company’s decision makers by:

- Time in position.

- Role within the company.

- Level of seniority.

Or perhaps the businesses themselves:

- Industry.

- State of growth.

- Number of staff.

This kind of information can tell you a bit about who’s buying your product, but it won’t tell you much about their motivations.

Herein lies the principal downside of demographic segmentation: it’s basic. For this reason, it’s best to combine it with other types to make your segments more useful.

The upside? Demographic data is easy to get hold of compared with other data types. It’s available for purchase from third parties, for free as census data, or available from your customers themselves if you’re willing to do primary research.

A good example of this is T-Mobile’s 2019 campaign targeting baby boomers - the company’s strategists pinpointed what older adults were looking for when buying a phone; which they found was the ability to connect with family and friends.

In response to these findings, the company unveiled a new data plan targeted towards customers 55+ which eradicated all of the unnecessary added extras you might find in a millennials plan, who, for instance, streams an ordinate amount of content via TikTok or Spotify.

Psychographic segmentation

Psychographic segmentation aims to answer the question, “Why do my customers buy?”

Specifically, psychographic data is concerned with the deep, underlying emotional motivators for buying decisions. Those tied to things like your customers’ values, hobbies, goals, and political affiliations.

As with behavioral data, psychographic data is difficult to collect.

It often requires close tracking across the internet. For example, what kind of content do your customers engage with in their free time? What do they upvote on social media? What pages do they follow, and can those pages be categorized?

If many high-value potential customers are environmentally conscious and this is one of only a few boxes you don’t currently tick for them, investing in environmentally friendly packaging and becoming carbon-neutral could constitute a massive win for your business.

For example, a company like Mercedes Benz focuses on customers who value luxury and status, while Volkswagen, which literally translates to ‘the people’s car’ in German targets an audience who value affordability and reliability.

Geographic segmentation

Geographic segmentation aims to answer the question, “Where are my customers buying from?”

This doesn’t just break down to which country the purchase was made from. You might also segment geographically by looking at:

- Languages

- Cities & counties.

- Postcodes.

- Regions (e.g. mountainous regions for skiing resorts)

Again, on the utility to ease-of-acquisition scale, this geographic data is not too dissimilar to demographic data. It’s easy to acquire, but is less useful than other types.

That’s not to say geographic segmentation is without its uses, though. It can answer some pretty important questions for you, such as what language it makes most sense to communicate in. The answer will change with your audience (English speakers in Silicon Valley? Or a wealthy, multicultural hub in Geneva?).

A single message isn’t likely to hit a home run across cultures either. Having solid geographic segments gives you an off-ramp to optimize your messaging for audiences across cultures.

For example, a company that sells only waterproof outerwear would have an easier time targeting markets in Seattle than say, Arizona.

Behavioral segmentation

Behavioral segmentation aims to answer the question, “Why and how are my customers buying?”

When building out segments based on behavioral data, you’ll look at the ways your customers buy and, when they do, the types of behaviors that accompany a purchase.

Here are some examples:

- Time on-site before buying.

- The on-site elements buyers engage with before making a purchase.

- Where they engage the least.

- Have they downloaded a lead magnet previously?

- Are they a member of your newsletter, or your members-only forum?

If you sell an app, have they downloaded that app? How long have they been using it for? If they allow you to collect usage data, how active are they on it?

Questions like these belong to behavioral segmentation, and the answers are valuable. Info like this takes more time and investment to collect and analyze, though.

Netflix has the perfect model of behavioral segmentation, with each user receiving recommendations completely unique to them and based purely on their viewing behaviors. The data doesn’t lie, around 80% of Netflix views come from the recommendation feature.

Market segmentation criteria/requirements

Once you’ve finished the market segmentation study, your results should be:

- Measurable

- Accessible

- Substantial

- Differentiable

- Actionable

Let’s unpack each in a little more detail...

Measurable

Segments should be easily measurable so that marketing strategists can decide whether, and to what extent, they should focus their efforts and resources. If you can’t measure your rate of growth then how will you know the segment is valuable?

Accessible

There’s no use selecting a market segment you can’t reach, whether that means geographically, or psychologically. After all, you wouldn’t market a software solution specifically for a doctor and try and sell it to a police officer, would you?

Substantial

The market segment must have the ability to buy your product. For example, almost everyone would like to own a private jet but can most of us actually afford it? Not in this lifetime!

Differentiable

Differences between market segments should be clearly defined so that your campaigns, products, and marketing tools can be used as effectively as possible without overlap.

Actionable

The market segment needs to provide supporting data for a marketing position or sales approach so that your intended marketing targets actually purchase a product.

The segmentation process in 6 steps

Here are the six steps to segmenting your market:

- Understand your target market.

- Define your market segments.

- Develop buyer personas.

- Create targeted messaging.

- Choose the right marketing channels.

- Measure and optimize your campaigns.

Step 1: Understand your target market

First up, you’ve got to understand your target market.

Before you can carve a statue, you need to get your hands on a block of marble. In the same way, you need to be able to visualize the entire pool of customers that could benefit from your product before you can build your segments.

That block of marble is your total addressable market, which we mentioned earlier.

Hopefully, you haven't built a product without knowing there’s a market for it. But there’s always a stage where you’re trying to align your vision with what the market wants relative to what’s already out there.

So, if you’re struggling to understand who your target market is, try sending out free samples or trials of your product. Compensate testers for their time, and ask for feedback on their experience with your product. Collect the details of those who like it and who say they’d use it; they represent your target audience.

Step 2: Define your market segments

Once you know your TAM, it’s time to start grouping. Use the methods we mentioned above to break your market (that block of marble) up into workable sections. Whether you combine various methods of segmentation to build your segments, or use just one, is up to you.

As we discussed earlier, your segments will be defined by their shared characteristics. What makes each segment unique from the rest is what makes it useful, so don’t be tempted to make the differences subtle, or the lines between segments blur.

With segments defined, identify the ones that represent the greatest opportunities for your business and prioritize them.

Step 3: Develop buyer personas

With a prioritized list of market segments in-hand, it’s time to develop your B2B buyer personas.

Buyer personas add an air of personalization to your marketing communications from here on out. They allow you to interact with the decision-makers in the businesses that make up the members of your segments in as human a way as possible.

Step 4: Choose targeted messaging

With buyer personas for each of your priority segments, you’re ready to start drawing up what your messaging will look like for each persona. It’s important your messaging is personalized and targeted so it can have the greatest possible impact.

If you’re to influence and persuade effectively, you’re going to have to earn the trust of those decision makers. By learning what makes them tick, and what drives their buying decisions, you’ll be well-placed to start framing your products in the best possible light, while earning that trust quickly and effectively.

Step 5: Choose the right marketing channels

As we mentioned earlier, one of the keys to having actionable market segments is to know you can communicate directly with the members of your priority segments.

That means choosing the right marketing channels.

As part of the process of developing your buyer personas, you’ll have figured out where your decision makers hang out, and on which platforms they’ll be most receptive to marketing communications.

Social media, YouTube, Google search results, and email are all great digital locations for your marketing communications. But trains, billboards, bus stops, television and movie commercials, magazines and newspapers… all of these are viable locations for your ads. You just have to pick the ones that make sense based on your research.

Step 6: Measure and optimize your campaigns

Finally, you’ll have to measure your campaigns.

Everyone knows it’s rare to knock it out of the park on your first try. If you learn from every at-bat you have, though, you’ll soon learn where you can make small improvements in your game.

Soon enough, home runs every time!

The same is true for your marketing campaigns. Solid data is hard to come by, so use the pre-validated data that comes in freely as a result of your marketing efforts to boost the results of future campaigns.

B2B vs B2C segmentation

B2C segmentation focuses on marketing to individual consumers – people like you and me. B2B is focused on marketing to businesses. The differences between B2B and B2C market segmentation are a result of the normal differences between consumers’ and businesses’ buyer behavior.

We’ve outlined five of the most impactful:

Businesses don’t impulse buy

Consumers impulse buy. Businesses don’t.

If you’re marketing to consumers, you can build this impulse buying phenomenon into your strategy. Not so with B2B. When businesses are your customers, the decision-making process is longer and more complex.

Why don’t businesses impulse buy? Usually, there’s more than one decision maker in a business. The person with the keys to the credit card is rarely the one who’ll be benefiting from your service in their daily line of duty.

In other words, when marketing to businesses, you have to convince more than one person you’re right for them.

B2B services can be more complex

The services you’re selling in B2B might be more complex. You might have multiple solutions, and might need to educate your prospects on the right one for them. The customer courting process is longer, which means there’s more room for error.

There’s more money at stake

There’s usually more at risk in B2B marketing, too. Winning a new enterprise account could mean landing thousands more users overnight. If your product works and helps the enterprise out, they could make a lot more money. If it doesn’t, they could be locked into an expensive contract for years and lose money on the deal, which makes them a more cautious buyer.

It’s trickier to strike the right balance

Since you’re dealing with multiple decision makers, it’s more difficult (though not impossible) to pinpoint a single “personality” or “persona” that you can speak to in your messaging. Plus, over-optimizing your messaging for the decision maker might make end-users very unenthusiastic about your product (and vice versa).

B2B market segmentation methods

Moving from your entire relevant market, aka your total addressable market (TAM), to a workable list of high probability prospects is a multistep process. You’ll first identify ideal targets by segmenting your TAM.

In B2B marketing, you’ve got a few segmentation methods to choose from:

Firmographic segmentation

Firmographics are, essentially, the business equivalent of “demographics” for consumers. They include aspects like:

- Company size.

- The industry they’re a part of.

- Annual revenue.

- Business maturity.

- Length of sales cycle.

As is the case with B2C, segmentation methods exist on a kind of continuum. At one end is all the data that’s easy and inexpensive to get hold of. Unfortunately, since it’s the most accessible, such data don’t offer much of a competitive advantage.

Technographic segmentation

Technographic segmentation has you segment businesses based on the tech they use.

Why would you want to do that?

Well, if you’re a SaaS company, or offer a tech product of any kind, breaking your TAM up based on the tech they already use is a great help. You’ll be able to quickly figure out whether there’s room in their tech stack for your product.

What’s more, the makeup of a business’ tech stack can tell you a lot about its maturity. Even if you can’t figure out what stage of growth a business is at, you might be able to find out what’s in its tech stack. From there, you stand a chance at figuring out whether that business is ready for your product, or if that ship has sailed.

Needs-based segmentation

With technographic segmentation, we mentioned you’d find out what tech a business was using, and use that to determine whether they might need your product now or in the future.

Needs-based segmentation follows a similar reasoning approach. Rather than with data on their tech stack alone, you’d look at all the data you can find about a business to determine the kinds of solutions it might need – now or in the future.

For example, you might determine that businesses only start looking for products like yours once they cross the mark of 1,000 employees. It’d make sense in this situation to market only to companies with more than 1,000 employees.

Behavioral segmentation

Behavioral segmentation in B2B marketing is almost exactly the same as in B2C. This time, rather than looking at the buying behavior of the consumer, you’re looking at the buying behavior of the businesses you’re targeting.

This is powerful, it helps you understand the conditions necessary for members of your target market to buy, for one. For two, it’ll help you find triggers for buying behavior.

For example, businesses in your sector might do a lot of buying right at the beginning of the financial year. This might tie into other data you’ve got, for example, if your sales team’s win rate is far higher in the three months immediately following the start of the new financial year.

Such information can inform your marketing strategy, as you can ramp up your marketing efforts during these higher probability months of the year to win more deals.

Buyer journey stage

As with B2C marketing, the stage of the buyer journey the businesses you’re targeting are at can make a big difference to the success of your campaigns.

When your prospects are at a more advanced stage of awareness, different types of marketing material will be more effective than if they’re barely aware there’s a problem they should be looking to solve.

This latter type of business won’t be ready for a pitch, and educational materials would make more sense. But a business that’s already looking for a solution like yours is ready to have their trust in your brand built, and to learn what makes your product stand out.

10 common market segmentation mistakes to avoid

Breaking your target market down into smaller, more digestible chunks is no small feat. It’s a large, time-consuming task requiring plenty of data, know-how, and patience.

As a result, there are a fair few pitfalls littered throughout the segmentation process.

We’ve collated a list of the ten most common market segmentation errors you’ll need to avoid if you want to create relevant, useful segments that inform your marketing strategy and drive revenue.

1) You don’t have enough data

A single data point doesn’t make a trend.

But just how much data do you need to come away with statistically significant findings?

The answer: more than you might think. In fact, the more data you have the better. When you work with greater volumes of data, you mitigate the influence any one outlier can have on your findings.

Imagine gathering data on just five customers to determine your customer segments, for example. That’s just not enough to start determining the shared characteristics that’ll help you segment your sample.

Even 500 might not be enough to get a truly accurate picture. When you work with tens of thousands of data points, though, you start to get a very clear idea of how to demarcate each segment.

2) You don’t have clean data

Once you’ve set up an efficient and automated data collection process, it’s easy to get overwhelmed by the sheer volume of data you’re dealing with.

That’s why it’s not enough just to capture the data. You need to standardize it, sorting it into a format that’s usable - ideally right as it comes in.

If you don’t, it‘ll be impossible to draw accurate conclusions.

Data on market participants from source X might columnize the data differently than source Y. It’s up to you to pull your disparate data sets together and standardize them. That means across data formats and column names, but it also means removing duplicate entries.

This can be a lot of work, but it’s necessary if you’re going to draw accurate conclusions about your data.

Fortunately, if you’re working with tabular data, tools exist that can help you merge, de-duplicate, and perform many other seemingly time-consuming tasks quickly.

Pandas is a python library that makes working with tabular data a breeze.

Though the learning curve is steeper than your typical spreadsheet software, you don’t have to be a coding genius to learn it. In fact, many people find it easier than working with spreadsheets once they get over the initial learning curve.

3) Your segments don’t align with your business objectives

Remember in school when you were given back a poorly graded assignment and told you’d answered the question you wanted to answer, rather than the one you were actually asked?

With large, effortful tasks like customer segmentation, it’s easy to fall into the same trap. It’s easy to lose sight of why you’re performing the task in the first place. By the time you near the end, you might be so motivated by the thought of handing over your final deliverable that you rush the process.

While you might identify some clear, accurate, and informative market segments from your research, it’s still up to you to make sure these align with your business goals and objectives.

For example, if your business is looking to break into the enterprise space, but you’ve a long history of serving SMBs, you’ll have an abundance of data from SMB-related segments, but comparatively little from enterprises. It’s up to you to put in the effort to acquire that hard-won data since it now aligns most closely with your business objectives.

In other words, don’t let survivorship bias creep into your market segmentation strategy, where you more heavily weight readily available data versus what’s most pertinent to your business’ goals.

4) Your segments don’t have longevity

Every segment has a shelf life, especially in today’s markets, but that doesn’t mean you can’t craft your market segments with longevity in mind.

Right now, yours might be a small outfit serving local businesses. But your executives might have aspirations to distribute internationally.

That’s why it’s important to ensure you’re working the aims of your executive team into your market segmentation efforts.

This way, your segments stand a chance at staying relevant to your business as it scales.

5) Your market segments aren’t specific enough

Without some breadth, your market segments won’t stand the test of time. If your business scales quickly, you’ll find yourself needing to update each segment more and more frequently.

The temptation here is to make your segments broader and less specific so your segments don’t become obsolete too quickly.

But your segments now suffer from a different problem: they’re not specific enough. And if your segments are too broad from the beginning, your attempt to give them more life will fall flat. They’ll never be relevant enough to perform their function in the first place.

Instead, keep segments focused on the relevant factors that drive your customer base’s purchases (whether demographic, psychographic, or behavioral).

Then, just make sure these segments align with your org’s vision for the future, rather than sacrifice specificity for breadth.

6) You don’t update your customer segments

Some, rather than update segments frequently, choose to never update them at all.

No matter how aligned with your company vision your segments are, they’ll still need a refresh every now and then. If your segments are even a few years old, they’re at high risk of becoming out of date.

One of the most common market segmentation mistakes lies in thinking segmentation is a ‘one and done’ type of task. Check back in with your segments annually. The better the job you do at creating segments that are specific and align with your business’ goals, the less work it’ll be to bring them up to date at each audit.

7) You rely on past behaviors to predict future events

Many businesses rely too heavily on behavioral segmentation.

Don’t get us twisted - behavioral segmentation is powerful. Geographic and demographic segmentation have their place, but they can’t really compare to behavioral segmentation when it comes to predicting buyer behavior in a way that’s specific.

For example, while it might be necessary to segment your audience according to which continent they live on, and it might broadly affect their buying decisions, it’s much more powerful to split your audience into categories like:

- Those that have signed up for your newsletter.

- Those that have joined your Slack workspace.

- Those that have brought a product in the past.

All of these are behavioral factors, and all this data is available if you know how to track it.

But that’s the problem. Since it’s readily available, businesses come to rely on it heavily and, in some cases, exclusively.

Past behavior is no guarantee of similar future behavior. And without paying adequate attention to market and industry trends, you might miss a coming shift in buyer behavior that renders your behavioral segments useless.

That’s why it’s important to incorporate other types of segmentation that can survive such fundamental shifts in the market.

8) You don’t use psychographic segmentation

While many businesses put behavioral factors at the top of the hierarchy, past behaviors aren’t always reliable predictors of future behavior.

Instead, understanding the fundamental emotional motivators that drive your customers’ buying decisions gives you a better understanding of how they might act no matter what’s going on in the world around them.

Enter psychographic segmentation.

Psychographic segmentation focuses on your target audience’s values, beliefs, and lifestyles to better understand what drives them to take action and make a purchase.

The drawback? This kind of data is perhaps most difficult to come by of all. But it’d be handy to have, right?

All those privacy policies you don’t have time to read? All those cookies you accept just to get the popup off the screen?

Many of these cookies track minute details of your behavior online, aggregate it, and analyze it for insights into who you are.

This data (called your online fingerprint) is sold to corporations looking to understand the market (and its participants - people like you) better. This is a multi-billion dollar industry, and it’s easy to see why.

Of course, you don’t have to buy aggregated data from shady tracking companies to get your hands on some psychographic data. You can perform your own primary research, consisting of qualitative customer interviews, surveys, and focus groups if you wish.

However you choose to acquire psychographic data, you differentiate yourself from the rest. This constitutes its own small competitive advantage, helping you reap the rewards of more accurate market segments.

9) You focus only on bottom-of-funnel leads

In a similar vein to how psychographic segmentation can get you closer to the deeper influences driving buyer decisions, you should also make sure you’re not only focusing on those who are close to the end of the buyer’s journey.

The very language we use to describe leads (“buyer’s journey”, “buyer decisions”, “buyer behavior”) has us focused on the end of that journey. But there are other factors influencing buyers before they’re even aware they’re in our funnel.

The solution? Include a target segment for those in lower stages of awareness. Those who might not know they need a problem solved yet. They make up a large portion of your potential future customers. If you can market to them effectively, you can tap into a commonly overlooked resource for massive revenue potential.

Who might be able to initiate a conversation with them that starts them on their journey to becoming a buyer?

And how can you target and influence these people to start those conversations and exercise their influence?

10) You don’t make your findings digestible

You’ll learn a lot during the segmentation process. But you need to be able to distill your findings into a format you can share rapidly with the rest of the business.

That’s why it’s crucial to take things further. Don’t just create your market segments and stop there.

Derive customer personas from your segments. The process makes each segment personal, distilling a group down into a single memorable avatar. This makes the key decision drivers for this segment easier to understand, communicate, and remember.

Customer segmentation examples

Gender

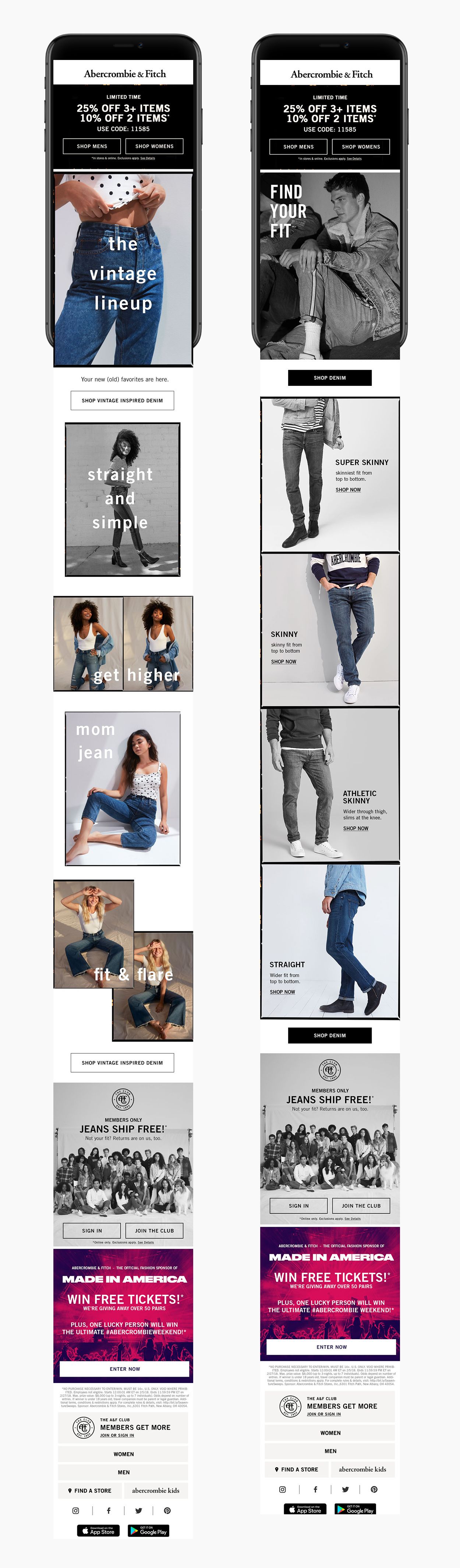

In this example, Abercrombie & Fitch segment by gender using the same campaign for men and women.

Although the offers are the same, the campaigns are slightly different.

A&F know that having the exact same campaign for both genders just won’t work. Instead, they've divided their customer profiles to see which trends appeal to female customers (e.g., vintage) and what appeals to their male customers (e.g., fitted jeans) when it comes to selling denim.

Age

Segmenting by age, Urban Outfitters has ads that target school, college, or university students.

This particular one is aimed at their University student target base. This offers a discount to students who more than likely only have their student loan to play with, new clothes to buy, and a dorm room to decorate. Which is why the website also has a section dedicated to dorm room interior design and school supplies.

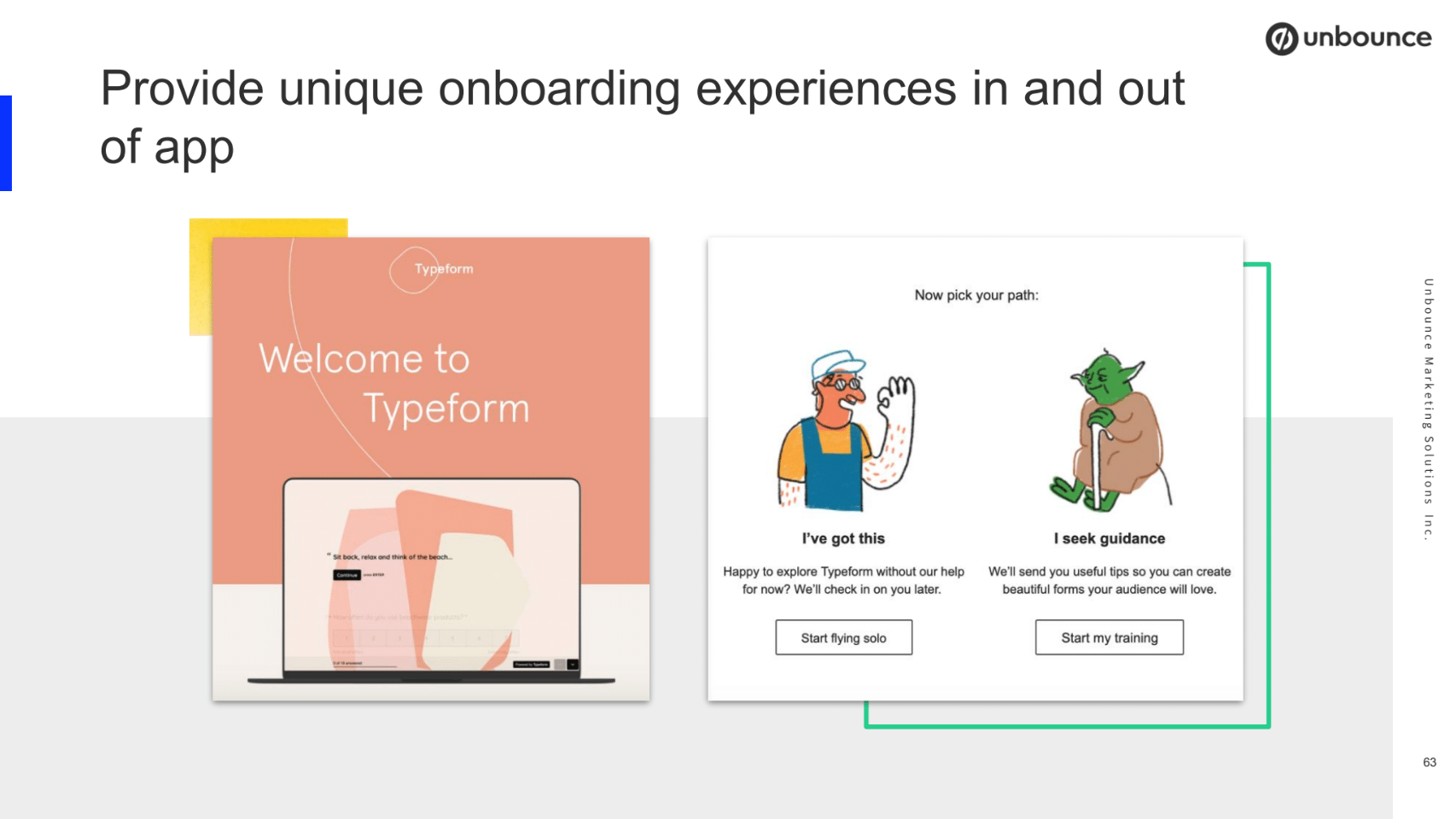

New customers/old customers

This is an email Typeform sends out when you sign up for their product. The email essentially asks the customer to self-segment themselves into either a new user or an old pro. These two customer segments will then receive a specific type of content targeted at their sophistication level, super relevant to where they are in their customer journey.

Tools, models and techniques

Cluster analysis and machine learning

One of the most common analytical approaches for market segmentation is cluster analysis. This involves grouping customers into clusters based on similarities in their data (e.g., demographics, behaviors, purchasing patterns).

- K-means clustering: Fast and efficient for large datasets, works best when you already have an idea of how many segments you want.

- Hierarchical clustering: Builds nested clusters without pre-specifying segment count, useful for exploratory analysis.

- Machine learning extensions: Today, marketers can use algorithms such as Gaussian Mixture Models or DBSCAN to detect more complex, non-linear patterns in customer data.

These methods are particularly powerful when paired with CRM data, web analytics, or product usage data.

RFM analysis

Recency, Frequency, Monetary (RFM) analysis segments customers based on their purchasing history:

- Recency: How recently they made a purchase.

- Frequency: How often they purchase.

- Monetary value: How much they spend.

This method is simple yet effective for eCommerce and SaaS companies looking to identify loyal customers, re-engage lapsed users, or optimize promotions.

Surveys, qualitative research and market data vendors

Not all segmentation is data-driven from internal systems. Surveys and interviews reveal psychographic and attitudinal insights that raw data cannot.

- Surveys: Useful for collecting values, preferences, and self-reported behaviors.

- Focus groups / interviews: Provide depth and nuance.

- Data vendors: Offer firmographic, technographic, or third-party behavioral data to enrich your segmentation.

A hybrid approach – combining qualitative and quantitative inputs – creates more robust segments.

Hybrid segmentation approaches

Many organizations achieve the best results by combining segmentation bases. For instance:

- Behavioral (purchase frequency) + Psychographic (values, attitudes)

- Firmographic (company size, industry) + Technographic (tools used) in B2B

This approach reduces over-reliance on a single dimension and often reveals “high-value micro-segments” that wouldn’t appear in siloed analysis.

What’s the relationship between market segmentation, targeting, and positioning?

Segmentation, Targeting, and Positioning (STP) is one of the most popular marketing models out there. In fact, Smart Insights conducted a survey where STP was revealed as the second most popular marketing model, behind the classic SWOT / TOWs matrix.

The STP model is useful for creating marketing communications strategies because it helps marketers prioritize propositions and develop and deliver personalized, relevant messages to different audiences.

STP is essentially the journey you take to position your brand in the minds of consumers, it’s the difference between yours and your competitor’s products.

Applying segments to marketing strategy (STP)

Segmentation is only step one. Once you identify your segments, you must decide:

- Targeting: Which segments are most attractive and aligned with your strategy? Consider segment size, growth potential, accessibility, and profitability.

- Positioning: How do you tailor your brand promise, messaging, and offerings to resonate with that segment? Positioning should make clear why your product uniquely meets their needs.

Tailoring messaging per segment

Different segments respond to different value propositions. For example:

- Price-sensitive buyers → emphasize affordability and efficiency.

- Premium buyers → highlight exclusivity, quality, and advanced features.

- B2B enterprise customers → stress scalability, compliance, and ROI.

Messaging can be adapted across channels — email, ads, sales collateral — ensuring consistency but also personalization.

Running campaigns and monitoring performance

Segment-specific campaigns should be designed and tested against KPIs such as:

- Engagement (CTR, open rates)

- Conversion (trial sign-ups, purchases)

- Retention and lifetime value

- Cost per acquisition per segment

Ongoing tracking ensures segments remain actionable rather than theoretical.

Maintaining and evolving segments

Revisiting and revising segments

Customer behavior changes over time due to market shifts, competition, or cultural changes. Review your segmentation at least annually, or more frequently in fast-moving industries.

Monitoring drift and segment exhaustion

Segments can lose relevance if:

- Customers evolve and no longer fit their original classification.

- Market saturation reduces growth potential.

- Segment profitability declines.

Segment drift analysis (tracking how customers “move” between segments) helps catch this early.

Feedback loops and metrics

Establish feedback loops to refine segments continuously:

- Monitor segment KPIs (growth, revenue contribution, churn).

- Collect qualitative feedback (customer interviews, NPS surveys).

- Use predictive analytics to anticipate when segments may change.

Newer segmentation trends

Micro-segmentation

Advances in analytics and data availability allow companies to create hyper-specific micro-segments, sometimes at the level of “segments of one.” While resource-intensive, micro-segmentation supports extreme personalization.

Predictive / AI-Based Segmentation

AI can forecast which customers are most likely to convert, churn, or upgrade. Algorithms analyze historical and real-time behavior to create dynamic segments that update automatically.

Implicit / inferred segmentation

Not all segmentation relies on declared data. Increasingly, segments are inferred from behavioral cues – such as browsing patterns, engagement levels, or even psycholinguistic signals in support chats.

Personalization at scale

Segmentation is evolving into personalization, powered by customer data platforms (CDPs) and real-time analytics. Brands can now deliver individualized experiences across touchpoints – without abandoning the structure of traditional segments.

Summary and next steps

Segmentation checklist

- Define objectives for segmentation

- Gather data (internal + external)

- Choose segmentation bases (demographic, behavioral, firmographic, etc.)

- Apply analytical methods (cluster analysis, RFM, surveys)

- Validate and test segment relevance

- Select target segments and craft positioning

- Design and run segment-specific campaigns

- Monitor and refine segments continuously

Further reading / resources

- Philip Kotler’s Marketing Management (STP framework)

- Harvard Business Review: “Rediscovering Market Segmentation”

- Industry reports from Gartner / Forrester on B2B segmentation

- Tutorials on machine learning clustering (e.g., K-means for marketers)

FAQs

What’s the difference between market segmentation and targeting?

Segmentation is dividing the market into groups; targeting is selecting which groups to pursue with tailored marketing.

What are examples of market segmentation?

A gym might segment by demographics (students vs professionals), behaviors (regular vs occasional exercisers), or psychographics (health-driven vs social members).

How many market segments should a company have?

There’s no fixed number — it depends on resources. Many companies focus on 2–5 high-value segments. Too many segments can dilute strategy.

What tools can help with segmentation?

Customer data platforms (e.g., Segment, BlueConic), analytics tools (Google Analytics, Mixpanel), and statistical software (R, Python, SPSS) are common.

Is geographic segmentation still relevant?

Yes – especially for retail, logistics, and region-specific offerings. However, digital products often benefit more from behavioral or psychographic segmentation.

How do I know if my segmentation is effective?

If your segments lead to clear messaging, measurable performance differences, and improved ROI, they’re working.

.png?v=d2feddaf5b)